INTERESTING RESIDENTIAL REAL ESTATE FACTS

A lot of people turn to residential real estate investing as a means to fund their lifestyles and to save for a comfortable retirement. While it’s the most common way to use real estate as an investment, there are several facts many people don’t know. Take a look below to learn a thing or two about residential real estate investing.

1. RESIDENTIAL REAL ESTATE QUALIFIES FOR MULTIPLE TAX BENEFITS

While every tax situation is unique, most residential real estate properties qualify for a host of tax credits including mortgage insurance, depreciation, repairs/maintenance, and even write-offs for travel expenses and meals in some cases.

2. YOU ARE IN COMPLETE CONTROL OF YOUR ASSET

When you buy into residential real estate, you control virtually all aspects of the deal. You only buy it if you’re happy with the price. You decide whether to manage it yourself or to hire a property manager. You and your property manager decide who will rent the property. And you decide whether to keep the property or to sell.

3. RESIDENTIAL REAL ESTATE IS A CONSISTENT MONTHLY CASH FLOW

Once your property is running smoothly – i.e. rent comes in and the mortgage payment goes out – you can count on consistent monthly cash flow. Having said that, however, there’s always the case where tenants don’t pay on time or unexpected repairs come up, so it’s important to have an emergency fund set up just in case.

4. YOUR TENANTS CONTROL CASH FLOW

Expanding on the point above, finding good tenants is vital to the success of your venture. Good tenants are hard to find, so when you do find one, you must do your part to ensure their satisfaction, for if they leave, you won’t have any cash flow coming in at all.

5. RESIDENTIAL REAL ESTATE APPRECIATES

This point is self-explanatory. In most cases, the longer you hold a residential real estate property, the more it should be worth.

6. YOUR TENANTS PAY THE COST OF OWNERSHIP FOR YOU

Once you have good tenants in your rental property and cash flow is consistent each month, it’s your tenants who are paying the cost of owning the property for you. The monthly mortgage, taxes, interest, insurance – all of it. Even if there’s a month or two where you only break even because of unexpected maintenance, you still come out ahead on the deal.

7. YOU HAVE OPTIONS WHEN BUYING RESIDENTIAL REAL ESTATE

Many people think they either have to pay cash for their investment or get a traditional loan. While these are viable options, you have other financing options at your disposal. Seller financing, self-directed IRA loan, private loan, lease with the option to buy – these are all options for financing your next residential real estate investment.

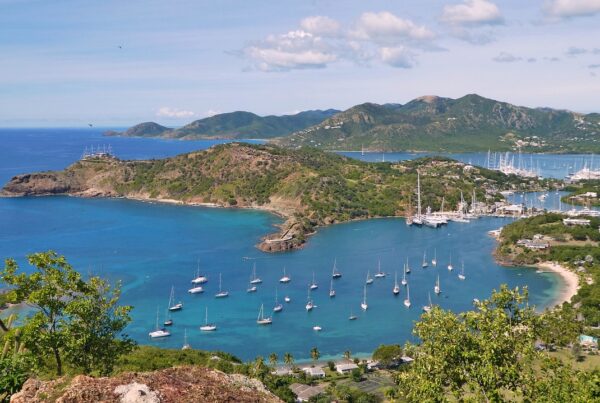

8. LOCATION IS KEY TO FINDING GOOD TENANTS

Certain locations attract a certain type of tenant. This means some locations may invite tenants who aren’t able to keep up with rent payments. Keep this in mind as you look for your next rental property investment.

Residential real estate offers investors a way to afford the things they want as well as to save for a comfortable retirement. While the venture seems pretty straightforward, there are several things you may not realize before getting started. Be sure to read the facts above to learn a thing or two about residential real estate investing.