Purchasing a private property as an Investment opportunity is a clever move on the off chance that you do it right. Unfortunately, the process can be overwhelming, particularly if this is your first time. A ton is going on and a great deal in question, so you need to go in with a reasonable understanding of what is in store.

With that in mind, we have assembled this short guide that examines a few of the main components you need to consider if you believe you are prepared to purchase your first Investment property.

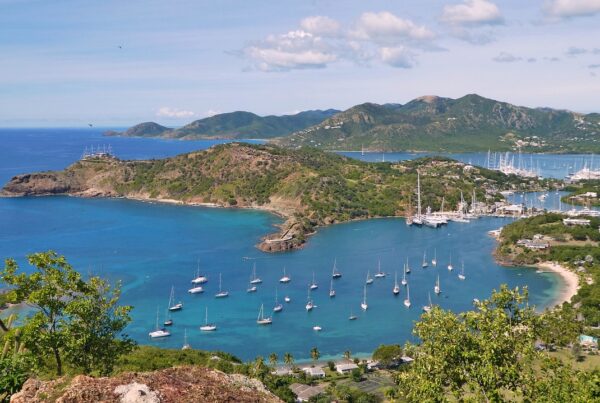

Area

Even though you will purchase a piece of actual property, you need to think about the area of that property before really thinking about the actual construction. This is on the grounds that the correct property in some undesirable area will not give you the returns you are expecting.

The Financing Down payment

The Financing Down payment on an investment property is a lot higher than that of a personal residential property. For a personal residential property, you generally just need 10 percent down, yet on an Investment property, you could be asked to put down 15-20 percent of the cost. Additionally, prerequisites and collateral requirements for an investment loan are frequently a lot stricter too.

Fixed and Variable Costs

Whenever you own a property, you should prepare to pay something beyond the expected month-to-month bills. Known costs, for example, Insurance, utility, property taxes, and routine costs, are not difficult to figure out. However, costs like replacing the water heater or fixing the rooftop after a major storm are a lot harder to foresee. Hence, you should have a maintenance fund saved to deal with these kinds of eventualities.

How Involved Would You Like to be?

Would you like to be an involved property owner who handles every one of the responsibilities related with your investment property? Possibly you do not have the time to do everything, in which case, you might need to consider hiring a property manager to do it for you.

You will have to analyze the expense of both – regarding time and money – and afterward, choose with respect to whether recruiting a property manager is the best decision for your needs.

The Dangers

Likewise with any investment, there are hazards implied when you buy a property for Investment purposes. Consider these carefully.

- You may not get the rental amount you anticipated.

- You may have to pay for costly renovations.

- Property taxes may go up.

- The economy/neighborhood market could decline.

- You might have awful tenants that may cost you money.

Putting resources into an investment property can be very productive in the event that you do it right. Consider the components above in case you are considering purchasing your first Investment property.